HDFC Bank, India’s largest private sector bank, is once again in the spotlight after its share price witnessed a sharp adjustment on August 26, 2025. At first glance, the stock appeared to crash by nearly 50–62%, sparking panic among retail investors. However, the reality is quite different. The correction was purely technical, as the stock turned ex-bonus following a 1:1 bonus share issue

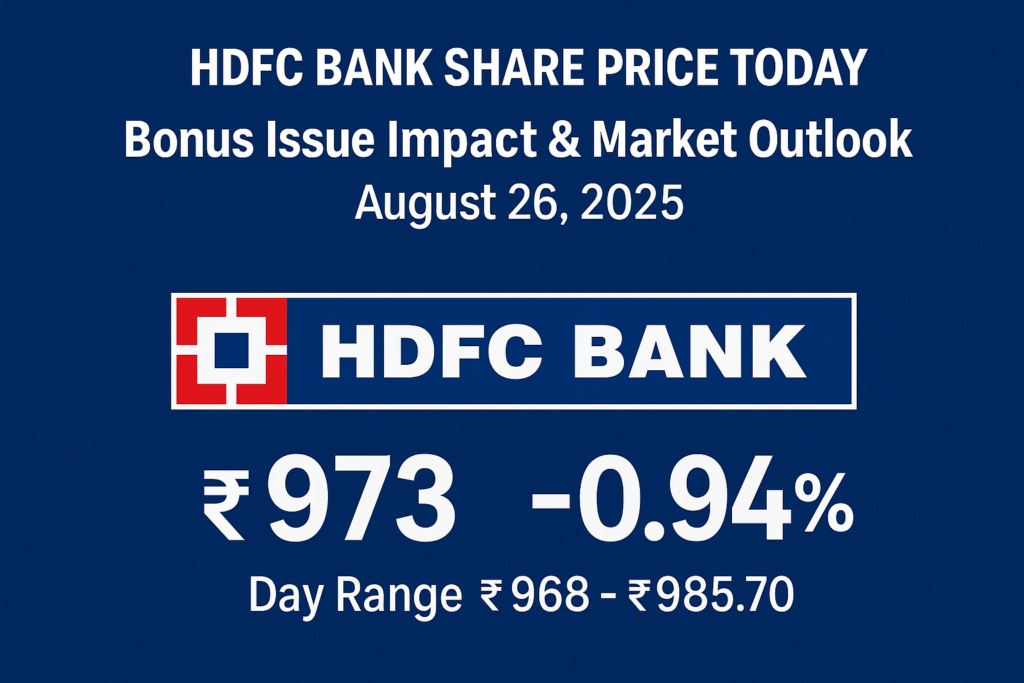

HDFC Bank Share Price Today

- Current Price: ₹972 – ₹973 (NSE & BSE)

- Day Range: ₹968 – ₹985.70

- Previous Close: ₹973.05

- Change: Around –0.9% (excluding bonus adjustment)

Expert Outlook on HDFC Bank Share Price

Market experts suggest that the technical adjustment should not worry investors. HDFC Bank remains a blue-chip stock with strong fundamentals

- Short-Term: Price may remain volatile as traders adjust positions

- Medium to Long-Term: Analysts expect steady growth in the banking sector, with

HDFC Bank Fundamentals (Post-Bonus)

Market Capitalization: Unchanged after bonus issue

PE Ratio: Adjusts in line with new earnings per share

Strong Balance Sheet: Consistent loan growth, digital banking expansion, and robust deposit base

DIGI MERCH STORE PRINT ON DEMAND

Impact on Investors

- No Wealth Loss: The overall portfolio value remains unchanged.

- Improved Liquidity: Lower stock price per share makes it more attractive for retail investors.

- Long-Term Benefit: Bonus issues often reflect strong confidence by the company in its growth outlook

Conclusion

The HDFC Bank share price drop seen on August 26, 2025, is a technical correction due to the 1:1 bonus issue, not an actual crash. Investors should stay calm, as their wealth is intact. With strong fundamentals and growth prospects, HDFC Bank continues to be a long-term wealth-creation stock.

hdfcbanksharepricebse. WebGraphics

hdfcbanksharepricense. Graphicdesigning

hdfcbankstockprice. dailyprompt-2124

hdfcbankbonusissue. PosterDesigning

Comment

Real user feedback curated for 1win apk review.