Tesla Inc. (NASDAQ: TSLA) has become one of the most influential and closely watched companies in the world. Founded by Elon Musk, Tesla has transformed the global automotive industry by leading the electric vehicle (EV) revolution, while also expanding into renewable energy and AI-driven technologies

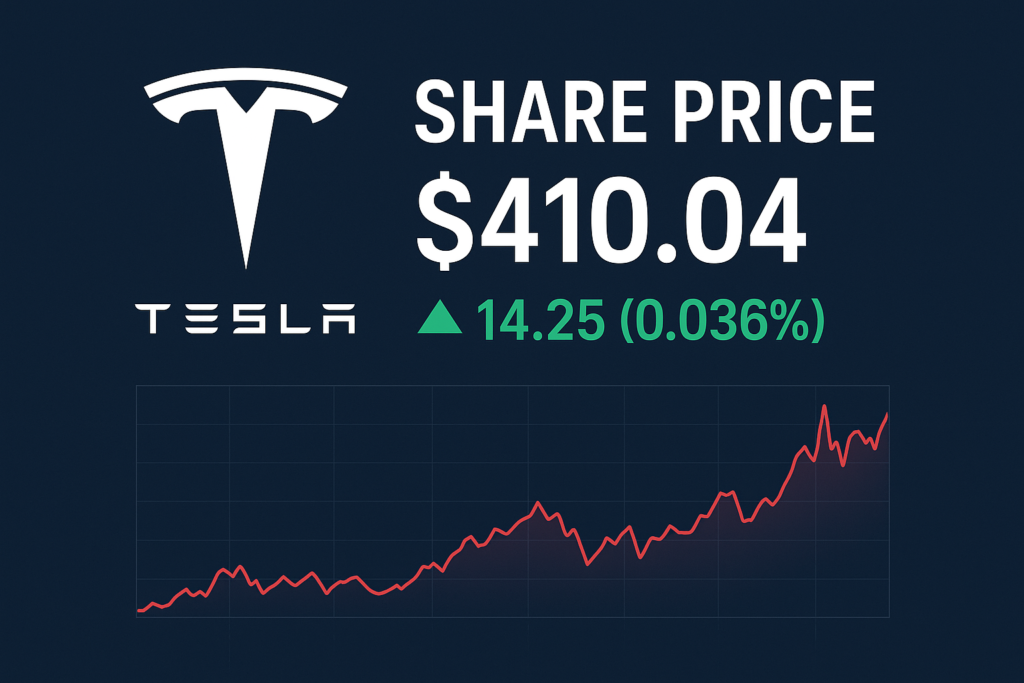

The company’s stock price is a reflection of not only its financial performance but also investor confidence in its long-term vision. As of the latest update on September 16, 2025, Tesla’s share price is $410.04, showing an intraday rise of +14.25 (0.036%).

Tesla Share Price Performance

- Current Price: $410.04

- Previous Close: $395.79

- Day’s Range: $397.66 – $430.22

- Open Price: $422.68

- Trading Volume: 163.8 million shares

Key Factors Driving Tesla’s Stock Price

Strong EV Demand

- With governments worldwide pushing for sustainable transport, Tesla remains at the forefront of the EV revolution. Rising deliveries and new product launches continue to fuel investor optimism.

Expansion into Energy Solutions

- Beyond cars, Tesla is expanding in solar energy and battery storage systems, strengthening its long-term growth prospects

Technological Advancements

- Updates on Tesla’s Autopilot and potential robotaxi services play a major role in investor sentiment

Global Market Presence

- Tesla’s expansion in Asia and Europe, along with its new Gigafactories, adds long-term growth potential

Investor Outlook

While Tesla’s stock price has seen significant fluctuations, it remains a popular choice for both growth-oriented investors and traders seeking volatility. Analysts suggest keeping an eye on quarterly earnings, production numbers, and upcoming product launches like the next-generation Tesla Roadster and Cybertruck updates.

DIGI MERCH STORE PRINT ON DEMAND

Risks & Challenges for Investors

High Competition: Legacy automakers like Ford, GM, Toyota, and new EV players like Rivian, BYD, and Lucid are ramping up their offerings.

Market Volatility: Tesla is known for large intraday price swings, which can be risky for short-term investors

Regulatory Pressure: EV tax credits, environmental policies, and safety regulations could impact Tesla’s profitability.

Global Economy: Rising interest rates, supply chain disruptions, or geopolitical tensions may affect Tesla’s operations

Predictions for Tesla Share Price

Short-Term: Price may fluctuate between $390 and $450 depending on Q3 earnings and delivery reports

Medium-Term (2026–2027): Expansion into India and Southeast Asia, plus robotaxi services, could push Tesla above $600 per share

Long-Term (2030 and beyond): If Tesla successfully scales energy storage and AI-driven robotics, analysts predict prices crossing $1,000 per share.

Teslastockprice. AffiliateMarketing

Comment

I do agree with all the ideas you have introduced on your post They are very convincing and will definitely work Still the posts are very short for newbies May just you please prolong them a little from subsequent time Thank you for the post