The Income-Tax Bill, 2025, originally introduced in the Lok Sabha on February 13, 2025, aiming to replace the Income-Tax Act of 1961, has been withdrawn by the government as of August 8, 2025, due to drafting errors and clause discrepancies

A revised version is scheduled to be introduced on August 11, 2025, incorporating feedback from a Select Committee under MP Baijayant Jay Panda

Key reforms in the withdrawn bill included:

Repealing and replacing the six-decade-old Income-Tax Act of 1961

Streamlining the tax code—simplifying language, reducing chapters from 29 to 23, and removing outdated provisions

Granting tax authorities more power to access digital data during searches (emails, social media, cloud platforms), raising privacy concerns

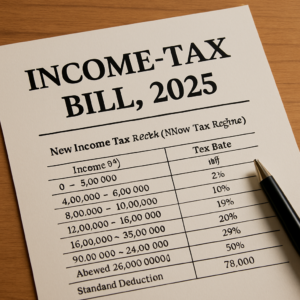

Income Tax Rates for FY 2025-26

Although the new Bill is pending, the Tax Rates under the Union Budget 2025 are already applicable, as part of the Finance Act. Here’s what’s changed for the upcoming financial year beginning April 1, 2025:

Tax-exempt income up to ₹12 lakh; with a ₹75,000 standard deduction, this translates to tax-free income up to approximately ₹12.75 lakh

Old Tax Regime (Optional)

No changes introduced in Budget 2025. The tax slabs, deductions, surcharge, and cess remain as before

Which regime suits you?

As a salaried individual, you can benefit from the new regime’s increased threshold and simplified structure—many may pay no tax even without deductions

However, if you claim multiple deductions (like under Section 80C, 80D, etc.), the old regime might still be better. It’s wise to compare both before deciding.

DIGI MERCH STORE PRINT ON DEMAND

Possible Implementation Timeline

Aug 11, 2025 – Revised Bill introduction in Lok Sabha.

Aug–Sep 2025 – Parliamentary debate & potential referral to Rajya Sabha.

Oct–Nov 2025 – Presidential assent (if passed).

April 1, 2026 – New Act could replace the Income-Tax Act, 1961.

Economic Context Behind the Bill

India’s direct tax collection crossed ₹19.5 lakh crore in FY 2024-25, showing strong compliance growth

Government’s aim: widen the tax base by making compliance simpler while closing loopholes.

Push towards new regime adoption — as of FY 2024-25, less than 25% of taxpayers had shifted to it.

IncomeTaxBill.

newincometaxrates

incometaxbillwithdrawal.

Indiaincometaxlawchanges.

oldvsnewtaxregime.

Comment: